|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

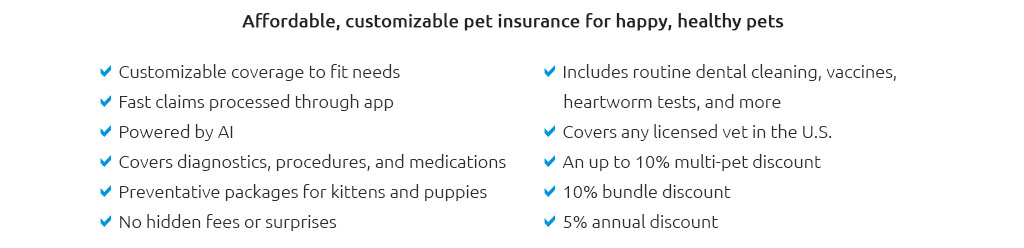

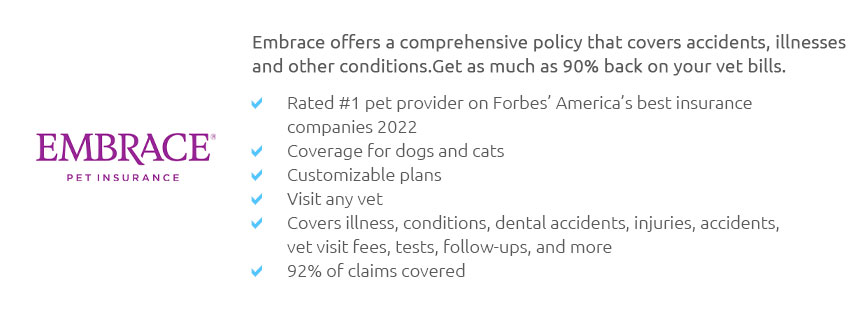

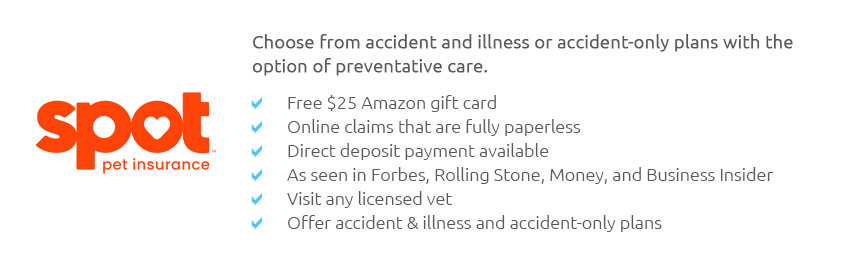

Exploring the Nuances of Pet Insurance and Vet Discount PlansThe world of pet ownership is a realm filled with joy, companionship, and at times, unforeseen expenses. As more pet owners seek ways to ensure the best care for their furry friends, the concepts of pet insurance and vet discount plans have gained prominence. But what are these options, and how do they differ? Pet insurance, much like health insurance for humans, provides a safety net against unexpected veterinary costs. It typically covers accidents, illnesses, and sometimes even routine care, depending on the plan. On the other hand, a vet discount plan is more of a membership program that offers reduced rates on veterinary services and products. It doesn’t cover costs directly but rather reduces the price you pay out of pocket. Choosing between these options can be perplexing. Pet insurance usually involves a monthly premium, which can vary widely based on factors such as your pet’s age, breed, and health condition. While it can be a lifesaver in emergencies, it's important to read the fine print as not all conditions or treatments may be covered. In contrast, vet discount plans are generally less expensive upfront, providing immediate savings on services. However, they lack the comprehensive coverage that insurance offers, potentially leaving you vulnerable to high costs if a major health issue arises. In terms of benefits, pet insurance provides peace of mind, knowing that you're protected against significant expenses. For many, it’s an investment in their pet’s future well-being, ensuring that financial constraints never hinder necessary care. Vet discount plans, while not as comprehensive, offer simplicity and predictability. They are excellent for routine care and can be particularly beneficial for households with multiple pets, where the cumulative savings on regular check-ups and vaccinations can be substantial. Ultimately, the decision between pet insurance and a vet discount plan should be based on your individual financial situation and your pet’s specific needs. For those who desire a safeguard against unpredictable health issues, insurance might be the wiser choice. Alternatively, if you are looking for a way to consistently reduce costs on regular vet visits and minor treatments, a discount plan could be more advantageous. In conclusion, both pet insurance and vet discount plans have their unique merits. They cater to different needs and preferences, offering pet owners the flexibility to choose what aligns best with their lifestyle and financial capabilities. As with any decision involving your beloved pet's health, careful consideration and research are paramount.

https://www.reddit.com/r/cats/comments/17i4onj/need_advice_for_pet_assure_discount_plan_usa/

At this point it's on her medical record so I doubt any insurance will cover costs related to it. Your vet is right, your cat 100% needs an echo ... https://www.comericavoluntarybenefits.com/familyandpersonalwellbeing/petdiscounts/pet-prescription-savings-plan.html

Visit a participating Pet Assure vet and present your member ID card at checkout. The veterinary staff will apply an instant 25% discount to in-house ... https://everyday.aon.com/MNCPPC/product/621c5560-70b9-11ed-a9a5-000d3a2b1014

Save on everything your pet needs from discounts on vet care and pet products to 24/7 telehealth and lost pet recovery services for less than ...

|